For decades, African countries have found themselves entangled in a web of loan accumulation from institutions like the World Bank and the International Monetary Fund (IMF). The question that lingers in the minds of many is: What is the driving force behind this perpetual cycle of borrowing and lending, and what do these international financial institutions stand to gain from it?

At first glance, the loans provided by the World Bank and IMF to African countries appear to be a lifeline for nations grappling with economic challenges, infrastructure deficits, and social development needs. These loans are often sought to finance essential projects, stimulate economic growth, and address pressing issues such as poverty alleviation and healthcare improvements. However, the reality is far more complex.

Read More:Ghana Secures $360m from IMF for Extended Credit Facility Review

One key aspect that cannot be overlooked is the power dynamics at play in the global financial landscape. The World Bank and IMF, as influential international financial institutions, wield significant power and influence over the economic policies and development agendas of borrowing countries. In exchange for financial assistance, these institutions often impose stringent conditions known as Structural Adjustment Programs (SAPs), which require countries to implement economic reforms such as austerity measures, privatization, and deregulation.

While these reforms are intended to promote economic stability and sustainable growth, they have often been criticized for their adverse effects on local populations, including rising inequality, social unrest, and compromised sovereignty. Critics argue that the loan conditions set by the World Bank and IMF prioritize the interests of creditors over the well-being of citizens in borrowing countries.

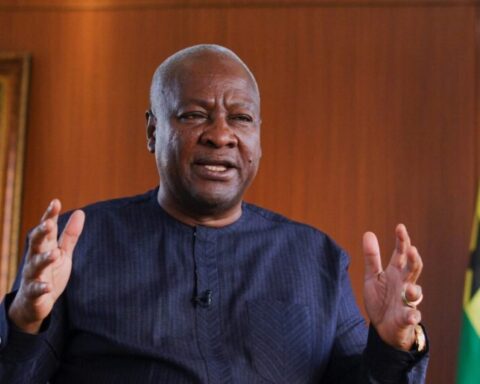

Economic Policy Analyst,Farouk Al Wahab, is of the opinion that these institutions , world bank and IMF are all simply business hub that only seeks to satisfy ist interest rather than the core interest of African countries.

Read More:“Sustain Programmes momentum for economic stability”-IMF Dir to Amin

The international Monetary Fund, and the World Bank (WB), continue to play a crucial role in supporting economic growth and reducing poverty in Africa. Recently, these institutions have intensified their efforts to improve Africa’s representation in their decision-making processes, focusing on the continent’s natural resources, supporting the energy transition, and implementing development projects.

For instance, the IMF has increased Africa’s representation south of the Sahara by adding another seat to its executive board, a move that underscores the continent’s importance in the global economy. Similarly, the World Bank plans to increase the number of directors from Africa on its board, strengthening the continent’s voice in crucial decisions.

Africa is rich in natural resources such as cobalt, manganese, and platinum, these are essential in the technology industry. Additionally, the continent has significant potential for alternative energy sources such as solar, wind, water, and geothermal energy, which can greatly contribute to a clean and sustainable energy transition.

Here, in Tanzania, the IMF recently ,announced the completion of the first review of the Extended Credit Facility (ECF) program for Tanzania, allowing the disbursement of financial assistance aimed at supporting economic recovery and promoting sustainable growth.

This program has been promoting economic and financial reforms in Tanzania and helping to strengthen the country’s economy.

In the first year of this program, Tanzania received 113.37 million (equivalent to US$153 million), which was provided to support economic recovery and maintain macroeconomic stability. This funding has significantly contributed to sustainable and inclusive economic growth in Tanzania.

According to a statement released by the World Bank on December 20, 2022, Tanzania received $775 million for two programs. It was also granted a $500 million loan for the first poverty reduction and sustainable growth program and a $250 million loan plus an additional grant of $25 million for the maternal and child health investment program.

IMF and World Bank’s commitment to debt restructuring, relief initiatives, and technical assistance in African countries reflects their dedication to promoting economic stability, preventing debt crises, supporting sustainable development, fostering economic reform, and addressing global economic imbalances. These efforts are pivotal for advancing the prosperity and well-being of African nations while contributing to global economic resilience.

However, this assistance comes with several conditions, including economic and financial reforms, debt sustainability, institutional cooperation, and monitoring and evaluation.

Read More:Tanzania among indebted countries relieved in IMF’s $1.9bn debt financing deal

From the perspective of the World Bank and IMF, lending to African countries serves multiple purposes. Firstly, it allows these institutions to fulfill their mandate of providing financial assistance to countries in need and promoting global economic stability. By extending loans to developing nations, the World Bank and IMF position themselves as key players in international development efforts.

Moreover, lending to African countries also presents an opportunity for these institutions to influence policy decisions and shape economic reforms in borrower nations. Through conditionality clauses attached to loans, the World Bank and IMF can push for reforms that align with their own economic ideologies and priorities.

Additionally, the repayment of loans with interest provides a source of revenue for the World Bank and IMF, allowing them to sustain their operations and fund future development projects. This financial return on investment further incentivizes these institutions to continue lending to African countries.

It is clear that the relationship between African countries, the World Bank, and IMF is a complex interplay of economic assistance, policy influence, and financial interests. While loans from these institutions can provide much-needed funding for development projects, the conditions attached to these loans and their long-term implications warrant critical examination. It is essential for African nations to carefully consider the terms of borrowing and ensure that financial assistance translates into sustainable development outcomes that benefit their citizens in the long run.