The Singapore government has granted its police force the power to freeze bank accounts and block money transfers if they suspect an individual is falling victim to a scam.

The new law, which came into effect on July 1, 2025, allows officers to intervene without waiting for a court order — a first in the country’s legal framework.

Authorities say the measure is essential to prevent irreversible financial losses, especially when victims refuse to believe they are being manipulated.

“We are empowering law enforcement to act fast — not to punish victims, but to protect them,” said a senior official from the Ministry of Home Affairs (Singapore).

In 2024, scam-related crimes surged to an all-time high in Singapore, resulting in S$1.1 billion (approximately USD $860 million, or £630 million) in total losses — nearly double the amount lost in 2022, according to the Singapore Police Force. Common tactics included phishing, impersonation scams, romance fraud, and fake investment schemes.

Many victims, often emotionally invested or unaware, ignore repeated warnings from banks and authorities — continuing communication with scammers posing as law enforcement officers, bank officials, or romantic partners.

The legislation, passed by the Parliament of Singapore earlier this year, allows police officers to:

- Freeze or restrict access to a bank account if a scam is suspected

- Disable access to mobile banking apps and online payment systems

- Block fund transfers before they are completed

- Notify banks and financial institutions directly

Victims will be notified immediately, and they retain the right to appeal the intervention through proper legal channels.

The new framework is guided by principles of proportionality, urgency, and data protection, according to the Monetary Authority of Singapore (MAS), the nation’s financial regulator.

Also Read; UK to Open Satellite Diplomatic Office in Dodoma

Despite broad public support, the move has sparked debate in Parliament, with some lawmakers warning of potential overreach and threats to financial privacy. Civil liberties groups are calling for stronger oversight mechanisms and independent reviews in case of abuse or mistaken identity.

Still, cybercrime experts argue that the benefits far outweigh the risks.

“Singapore is treating scams as a form of cyberterrorism — which they are,” said a researcher at the National University of Singapore. “This is about real-time protection, not surveillance.”

Singapore now joins a small but growing list of countries giving police powers to intervene in banking operations in response to scams. Similar proposals are being explored in the United Kingdom, Australia, and Canada.

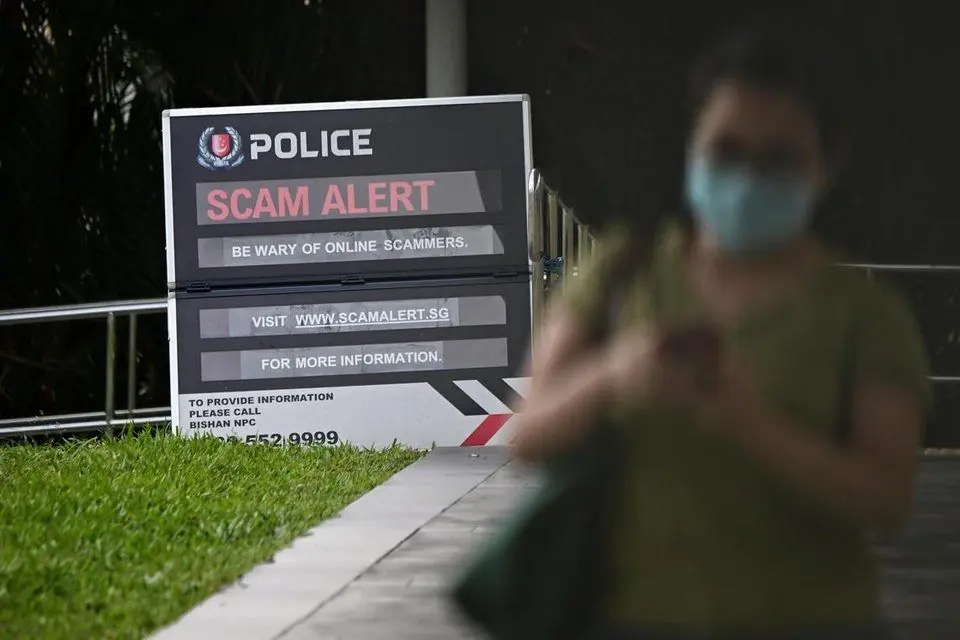

The move complements existing efforts like the ScamShield app — launched in 2023 to block scam calls and filter fraudulent SMSes — and extensive public education campaigns by the Cyber Security Agency of Singapore (CSA).

Singapore’s strategy is now being closely watched by regional neighbors seeking to curb the same digital exploitation threatening their populations.

Authorities continue to urge the public to remain vigilant, cross-check messages, and report suspicious interactions through the Anti-Scam Helpline or the Police Scam Alert Portal.

“Your bank will never ask for your password,” a recent campaign poster reads. “But scammers will.”

For victims and their families, the ability to act before the money is gone offers hope — and the law may be the firm hand needed to save lives and life savings.