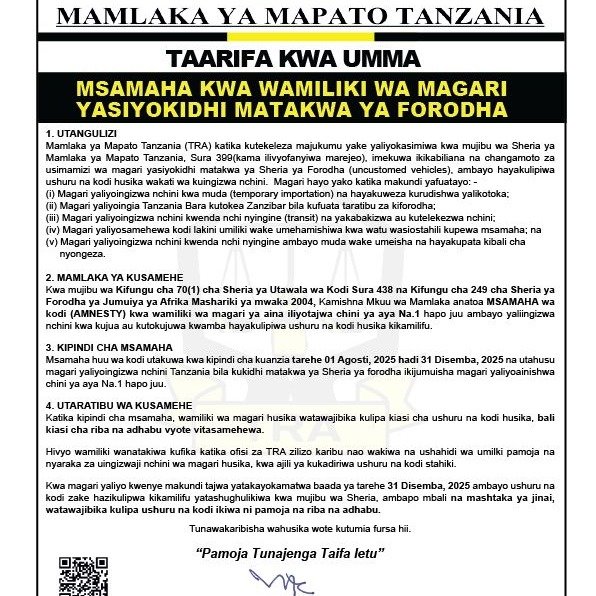

The Tanzania Revenue Authority (TRA) has declared a tax amnesty for owners of vehicles that were not subjected to proper customs clearance. The amnesty, which started on August 1 and will run until December 31, 2025, allows vehicle owners to pay due taxes and duties without incurring any penalties or interest.

In an official statement issued on August 1, 2025, in Dar es Salaam and signed by Commissioner General Yusuph Juma Mwenda, TRA emphasized that the move targets vehicles that are classified as “uncustomed” — those that bypassed the required customs protocols upon entry into the country.

The TRA cited several categories of such vehicles, including:

-

Temporarily imported vehicles that were never returned to their origin country.

-

Vehicles brought from Zanzibar to mainland Tanzania without following customs procedures.

-

Transit vehicles intended for other countries that were instead retained or abandoned in Tanzania.

-

Tax-exempt vehicles that were later transferred to ineligible individuals.

-

Vehicles that overstayed their authorized period in the country without proper extensions.

This amnesty is in line with Section 70(1) of the Tax Administration Act, Chapter 438, and Section 249 of the East African Community Customs Management Act, 2004.

According to TRA, the initiative is designed to help vehicle owners — whether knowingly or unknowingly non-compliant — to regularize the status of their vehicles. Only the principal taxes and duties will be payable during the amnesty window, while fines and interest will be waived entirely.

TRA encouraged all concerned individuals to take advantage of this opportunity, as the government intensifies efforts to streamline compliance and customs enforcement across the country.