Tanzania is moving closer to establishing a formal legal framework for Islamic finance, a development that could position the country as a leading hub for Shariah-compliant investment in East Africa.

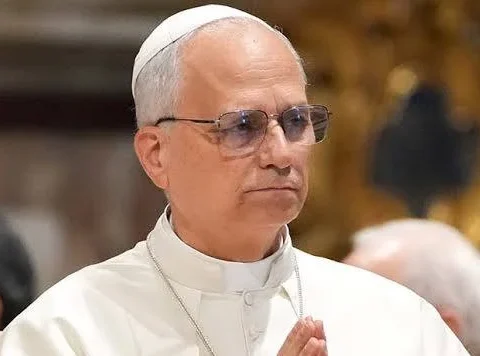

The central bank governor confirmed that a draft Islamic finance policy has been prepared and is ready for review in the new Parliament. The policy aims to standardize operations across banking, insurance, and capital markets, providing a cohesive framework for products such as Sukuk—Islamic bonds, Takaful—Shariah-compliant insurance, and halal investment funds.

“The draft document specifically dedicated to Islamic financing has been prepared and will be presented to Parliament,” the governor said. “We have already amended some of the existing financial regulations to ensure that Islamic finance can operate smoothly within our system.”

Experts say the legislation could significantly expand the sector, which has grown steadily despite the absence of a comprehensive regulatory framework. Until now, financial institutions offering Shariah-compliant products had to navigate a patchwork of conventional regulations, limiting their ability to introduce innovative products and services. The new policy is expected to provide clarity on governance, risk-sharing arrangements, and taxation, aligning the sector with international Islamic finance standards.

Also Read; Tanzania Appoints Mwigulu Nchemba as New Prime Minister

Market analysts note that the policy could attract foreign investors seeking ethical and faith-based investment opportunities. By establishing a unified regulatory framework, Tanzania would join a growing number of countries in Africa and the Middle East formalizing Islamic finance, enhancing transparency and boosting investor confidence.

Despite the optimism, industry stakeholders caution that passing the law is only the first step. Implementation will require careful coordination, training of financial sector personnel, and awareness campaigns to educate consumers about Shariah-compliant financial instruments. Aligning tax and regulatory treatment with conventional systems will also be critical to avoid ambiguity.

If enacted, the legislation is expected to unlock new investment opportunities and strengthen Tanzania’s position as a financial center in the region. Observers say the draft law signals the government’s commitment to diversifying the economy and catering to the growing demand for ethical and faith-based financial products, both domestically and internationally.