Brazil, Russia, India, China, South Africa, and recently admitted members — are gaining renewed momentum around the development of alternative financial architecture, including mechanisms for gold-linked trade settlement and new currency frameworks aimed at reducing dependence on traditional Western systems.

At a finance ministers’ meeting last week, BRICS representatives evaluated proposals to expand the use of local currencies and explore structured trade arrangements beyond simple bilateral swaps. These conversations are part of a broader strategy to challenge long-established dollar dominance and create a more diversified international monetary landscape.

A key area of focus was the possible use of gold-backed instruments or commodity-linked digital settlement tools to support intra-bloc trade. Supporters argue that structured integration within the BRICS financial architecture could provide stability against currency volatility and geopolitical shocks.

Another important pillar in the discussion is the strengthening of institutions such as the New Development Bank (NDB), which continues expanding its lending in local currencies. Officials believe the NDB could play a central role in facilitating cross-border settlement mechanisms and reducing reliance on traditional Western-dominated financial

Also Read: Ukraine Diplomacy Intensifies Amid Security Guarantee Talks

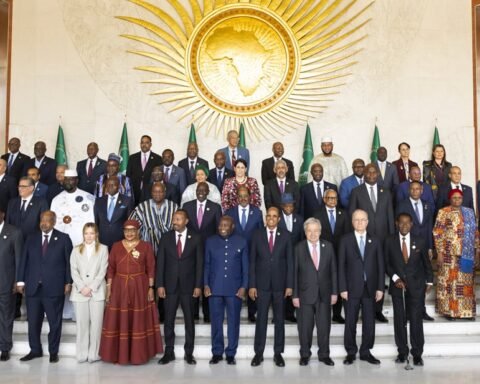

Meanwhile, trade experts note that expanded cooperation between BRICS economies may also intersect with regional frameworks such as the African Continental Free Trade Area (AfCFTA), particularly as African economies seek diversified reserve strategies and reduced foreign exchange exposure.

Although no official decision has been announced regarding a unified BRICS currency, technical committees remain active in reviewing models that could combine a basket of member currencies with commodity anchors like gold. Analysts caution that any transition away from the U.S. dollar would be gradual, given its entrenched role in global reserves and commodity pricing.

Still, 2026 discussions signal a determined effort by emerging economies to reshape the global financial order — not through abrupt disruption, but through steady institutional development and strategic monetary coordination..