African development banks are stepping up efforts to reduce reliance on the U.S. dollar in intra-African trade, promoting the use of local currencies and regional settlement mechanisms as part of a broader strategy to strengthen economic sovereignty.

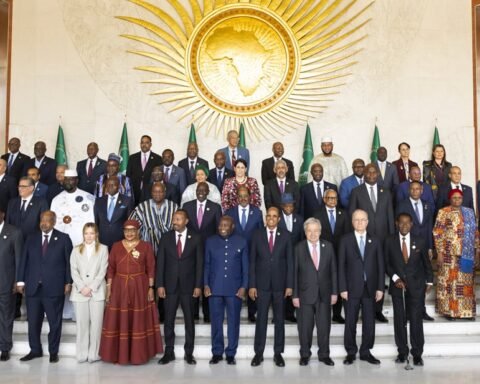

At a continental finance conference held in Abidjan from 19–20 February 2026, representatives from the African Development Bank (AfDB), the West African Development Bank, and regional monetary unions discussed frameworks to facilitate trade using national and regional currencies. The initiative aims to enhance financial stability and reduce exposure to foreign exchange volatility.

The move is closely aligned with the objectives of the African Continental Free Trade Area (AfCFTA), which encourages cross-border commerce and industrial integration. Delegates emphasized that local currency settlements can help lower transaction costs, minimize currency conversion risk, and support intra-African value chains.

Also Read: Africa Must Lead Sovereign Debt Negotiations Boldly

Officials noted that reliance on the dollar has historically exposed African economies to external shocks, including global interest rate shifts, sanctions, and exchange rate volatility. By creating a robust framework for regional currency trade, development banks hope to strengthen resilience and empower African states to negotiate trade terms more effectively.

The conference also highlighted the potential for digital and blockchain-based payment solutions to facilitate faster, secure, and transparent cross-border transactions. Experts from several African central banks suggested pilot programs linking regional currencies to commodity-backed reserves, drawing lessons from BRICS and other emerging market collaborations.

Finance ministers attending the conference underscored the long-term vision: a more integrated African financial system that fosters trade, reduces dependency on foreign currencies, and supports the continent’s industrialization agenda. They stressed that institutional capacity, regulatory harmonization, and regional cooperation will be critical to the initiative’s success.

Economists see this development as a significant step toward Africa’s financial autonomy. By leveraging development banks and regional trade platforms, the continent can gradually reduce the systemic risks of dollar dependency while promoting sustainable economic growth.