Competition between the United States and China over Africa’s critical minerals is entering a decisive phase, as both powers move aggressively to secure supply chains vital for clean energy, defense technology, and advanced manufacturing.

In recent weeks, diplomatic envoys from Washington and Beijing have engaged mineral-rich governments across Southern and Central Africa, offering financing packages, infrastructure support, and technology partnerships linked to lithium, cobalt, and rare earth extraction. The strategic goal is clear: control over minerals that power electric vehicles, battery storage systems, and next-generation electronics.

China currently dominates much of the global rare earth processing capacity and has long-standing mining investments across Africa. However, the United States and its European allies are stepping up counter-efforts, encouraging diversification of supply chains and promoting alternative partnerships through development finance institutions.

African governments are carefully navigating this rivalry. Officials from mineral-producing nations have emphasized that the continent will no longer accept agreements that export raw materials without building domestic value chains. Several states are revising mining codes to mandate local processing, employment quotas, and technology transfer requirements.

Also Read: South Korea Sentences Former President Yoon Life

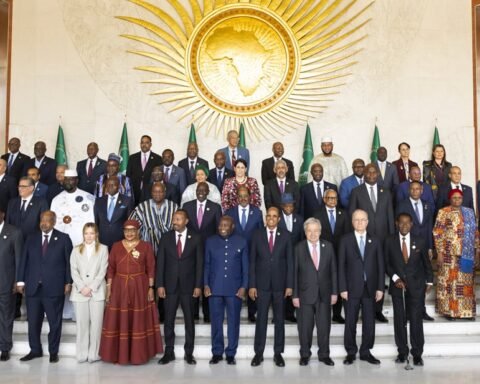

The broader continental framework, under the African Union Agenda 2063, underscores industrialization as central to long-term sovereignty. Leaders argue that critical minerals represent a generational opportunity to shift from extractive dependency toward manufacturing and energy leadership.

The stakes extend beyond economics. Control over battery minerals is increasingly viewed as a matter of national security. The Ukraine war and global trade disruptions exposed vulnerabilities in concentrated supply chains, prompting Western policymakers to accelerate reshoring and diversification strategies.

At the same time, Beijing continues to deepen infrastructure-linked mineral deals, often combining mining projects with road, rail, and port development. These integrated packages appeal to governments seeking rapid industrial growth, though critics warn about debt sustainability and transparency.

The African Development Bank has urged member states to negotiate strategically, emphasizing transparency and long-term planning to avoid exploitative arrangements. Economists note that while foreign investment remains essential, ownership structures and fiscal terms determine whether mineral wealth translates into sustained national development.

Environmental concerns also weigh heavily. Communities near mining zones are demanding stricter safeguards against pollution and land degradation. Civil society organizations argue that strategic minerals must not become a new source of ecological harm.

As 2026 unfolds, Africa stands at the center of a global supply chain contest. The challenge for policymakers is to transform geopolitical competition into leverage — ensuring that rivalry between major powers results in better contracts, stronger institutions, and genuine industrial transformation.