China is strengthening its footprint in Africa’s critical minerals sector, signing new agreements focused not only on extraction but increasingly on local processing and refining capacity across the continent.

In recent weeks, state-backed firms from China have expanded negotiations with governments in Southern and Central Africa to develop rare earth separation plants and lithium refining facilities. The move signals a strategic shift: securing long-term control over processing infrastructure rather than relying solely on raw mineral exports.

Africa holds significant reserves of cobalt, lithium, graphite, and rare earth elements — materials essential for electric vehicles, wind turbines, defense technologies, and advanced electronics. While the Democratic Republic of Congo dominates global cobalt production, countries such as Namibia, Zimbabwe, and Tanzania are becoming increasingly important players in the battery minerals supply chain.

For Beijing, the strategy is clear. China already controls a large share of global rare earth processing capacity. By investing directly in African refining plants, Chinese firms aim to secure upstream and midstream supply chains amid intensifying competition with the United States and European partners.

Western governments have grown more vocal about supply chain vulnerabilities, particularly as clean energy transitions accelerate. Washington and Brussels have launched initiatives encouraging diversification of mineral sourcing away from China. Yet many African leaders argue that competition between major powers should translate into better deals for the continent.

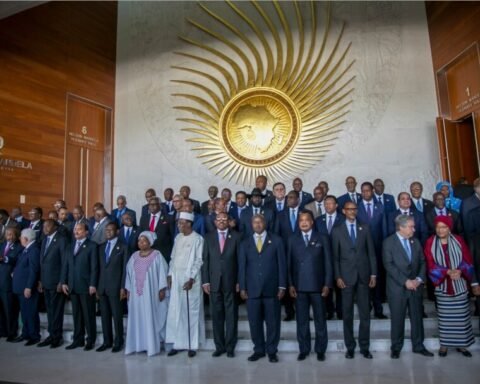

Officials within the African Union have repeatedly emphasized that mineral partnerships must prioritize local industrialization, technology transfer, and skills development. Processing minerals domestically — rather than exporting raw ore — is increasingly seen as central to economic sovereignty.

Communities near mining zones, however, remain cautious. While new processing facilities promise jobs and infrastructure, environmental safeguards and fair revenue distribution remain critical concerns. Past mining booms have not always translated into broad-based development, leaving some regions with degraded land and limited long-term benefits.

Economists note that refining capacity requires reliable electricity, water access, and transportation networks — infrastructure that remains uneven in parts of Africa. Governments negotiating with Chinese firms are therefore seeking integrated agreements that include power generation and logistics development.

The broader geopolitical implications are significant. Rare earths and battery metals are no longer just commercial commodities; they are strategic assets shaping the global balance of technological power. Control over processing determines who captures the highest value in the supply chain.

For African policymakers, the central challenge is managing this rivalry wisely. By negotiating transparent contracts, enforcing environmental standards, and mandating local value addition, nations can transform global competition into leverage for sustainable develop