Several African governments are intensifying discussions on alternative debt restructuring frameworks as pressure mounts from rising servicing costs and tightening global credit conditions.

Finance ministers from countries in East and Southern Africa met this month to review options that go beyond traditional programs backed by the International Monetary Fund (IMF). While IMF support remains central to many restructuring efforts, policymakers are increasingly examining diversified financing channels to reduce dependency and regain fiscal flexibility.

Public debt across parts of Africa has risen sharply over the past decade, driven by infrastructure borrowing, pandemic-era spending, and currency depreciation. With global interest rates remaining elevated, servicing dollar-denominated loans has placed heavy strain on national budgets.

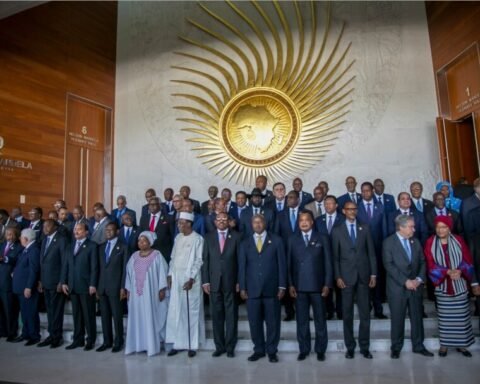

In response, governments are exploring regional solutions under frameworks linked to the African Union and deeper coordination through the African Continental Free Trade Area (AfCFTA). Officials argue that stronger intra-African trade and industrialization could improve revenue generation and reduce reliance on external borrowing.

Some states are also negotiating directly with bilateral creditors, including China and members of the Paris Club, seeking extended maturities and revised repayment schedules. Others are examining the use of local currency bond markets to refinance portions of external debt and strengthen domestic capital markets.

The debate reflects broader concerns about financial sovereignty. Critics of traditional debt programs argue that conditionalities attached to IMF agreements — including fiscal consolidation measures — can slow growth and restrict policy space. Supporters counter that disciplined macroeconomic reform is necessary to restore investor confidence and stabilize currencies.

Private sector creditors remain a key variable. African governments are increasingly pushing for comparable treatment from bondholders during restructuring negotiations, arguing that burden-sharing must be equitable across all creditor groups.

Meanwhile, development banks are stepping up discussions around innovative financing tools, including blended finance structures and climate-linked debt swaps. These mechanisms aim to align fiscal relief with long-term development goals.

For ordinary citizens, the stakes are tangible. High debt servicing crowds out spending on healthcare, education, and infrastructure. Governments face the challenge of restoring fiscal balance without deepening social hardship.

Analysts say 2026 could prove pivotal. If African states successfully coordinate debt strategies, strengthen domestic revenue systems, and expand regional trade integration, they may gradually shift from reactive crisis management toward proactive financial planning.